Recently, according to local media reports in Brazil, earlier this week, the new administrative order submitted by the Brazilian government to the congress contains a new measure related to tightening tax exemptions.

According to the Brazilian Ministry of Finance, it will tighten the rules for using the federal PIS-Cofins tax credit vouchers. The Ministry of Finance believes that this rule is a loophole and therefore needs to tighten the rule to fill tax loopholes in multiple industries and to support the Brazilian government’s plan to eliminate the deficit this year.

However, this measure has been strongly opposed by the agricultural sector. Affected sectors include pharmaceuticals, meat, fruits, coffee, grains, and biodiesel (vegetable oil or animal oil), and these exporters are expected to reduce their income by 26.3 billion reais (4.91 billion US dollars).

In this regard, the executive secretary of the Ministry of Finance said at the press conference that this measure does not mean increasing taxes and interest rates, but correcting the “distortion phenomenon that needs to be solved sooner or later.” It also pointed out that this move is expected to increase the government’s revenue by up to 30 billion reais (5.66 billion US dollars) to eliminate the government’s budget deficit.

At present, the new tax rule will take effect immediately, but it needs to be approved by the congress within four months to continue to be valid. Therefore, many agricultural product exporters in Brazil have organized lobbying groups to criticize the government for launching new rules for tax credits. At present, associations of soybean, coffee, and cotton exporters have joined the lobbying group, which increases the possibility of the congress rejecting the government’s proposal.

In addition, the Brazilian Coffee Exporters Commission (Cecafé) recently issued a statement claiming that the purpose of the PIS-Cofins tax credit vouchers is to provide driving credit for coffee exports, which will affect the cash flow of coffee export companies, affect costs, and the government’s new tax measures will force enterprises to rely more on banks to obtain credit, thereby increasing expenditures and increasing the operating burden. This move may trigger food inflation and unemployment in Brazil, ultimately resulting in a reduction in the international competitiveness of Brazil, the largest coffee exporter in the world, which is completely contrary to the vision of bringing foreign exchange income, economic, and social development to the Brazilian nation.

In addition, some analysts said that since the measure has already taken effect and it is necessary to wait for whether the congress will approve the new policy, in the recent period, some soybean and coffee growers have already stopped selling the agricultural products in their hands, and the long-term slowdown in export sales may prompt international buyers to seek other alternative sources, and it may thus cause prices to rise.

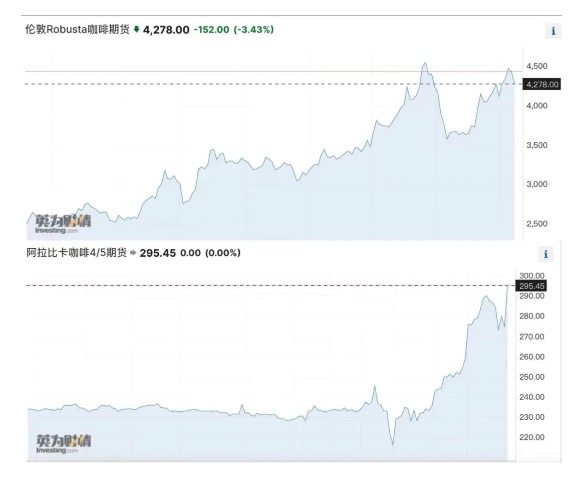

In addition, some people in the coffee industry believe that due to the recent drought and other harsh weather in Vietnam, which has led to a reduction in production, both Robusta and arabica coffee futures prices are continuing to rise. But currently, Brazil may tighten coffee exports, which will undoubtedly increase the possibility of rising coffee futures prices.

+ There are no comments

Add yours