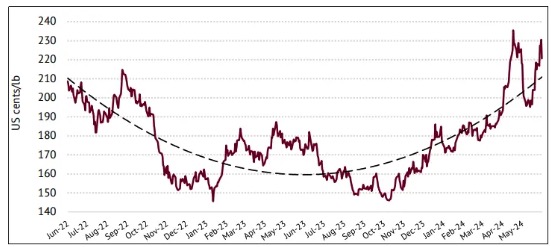

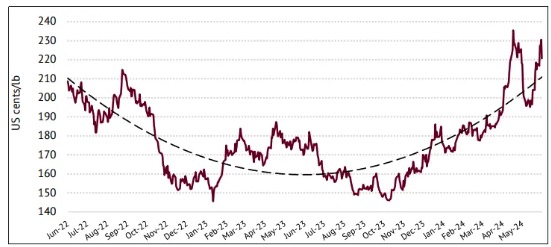

Recently, the International Coffee Organization (ICO) released the monthly report of the global coffee market in May, showing that the average price of the comprehensive index is 208.38 cents/pound, which has slightly decreased by 3.9% compared to the previous month.

In May, the comprehensive index price has been fluctuating between 195.13 cents and 230.61 cents. At the end of April, the world’s second-largest coffee-producing country, Vietnam, experienced a large-scale drought, and farmers were worried that the drought would cause irreparable damage to the coffee plants, which led to an increase in prices.

But at the beginning of May, it began to rain in Vietnam, which relieved farmers’ concerns about the large-scale drought. In addition, Brazil reported that the local weather was rather dry with limited rainfall, which allowed the coffee harvest work to proceed smoothly, so the index price began to fall.

However, in mid-May, the index price began to rise due to the uncertainty in the supply of coffee crops in both Brazil and Vietnam, the two major coffee countries, as well as in Central America due to dry weather and temperatures higher than the average. Another factor is that the continuous devaluation of the Brazilian currency real has continued to put pressure on coffee prices in May.

Both the American ICE exchange and the European ICEU exchange saw a significant increase in the number of coffee inventories, with the number of coffee inventories in the American ICE exchange increasing by 30.3% to 840,000 bags, while the number of coffee inventories in the European ICEU exchange increased by 24.9% to 780,000 bags.

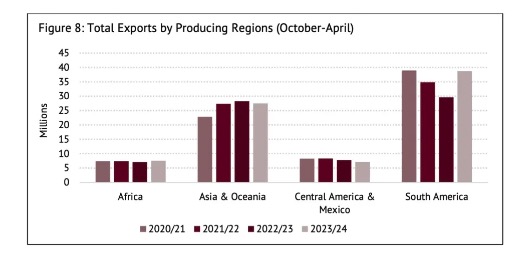

The increase in inventories is mainly due to the increase in the global export volume of coffee green beans. In April, the total export volume of coffee green beans was 10.77 million bags, an increase of 15.3% compared to the same period last year.

Among them, in South America, it increased by 44.5%, reaching 5.15 million bags, mainly due to the strong growth in Brazil. Brazil’s coffee exports were 4.24 million bags, an increase of 54.8% compared to the same period last year, which is the largest export volume on record in April.

In Africa, coffee exports also increased by 39.4%, reaching 1.37 million bags, mainly due to the growth in exports in April in Cote d’Ivoire and Ethiopia. Compared with the same period last year, Cote d’Ivoire increased by 202.5%, and Ethiopia increased by 103.6%.

However, at the same time, due to the fact that both Vietnam and Indonesia have experienced a reduction in production, the coffee exports in Asia and Oceania have decreased by 0.3% compared to the same period last year, to 3.78 million bags.

In addition, there is also a situation of reduced exports in the regions of Mexico and Central America, with a decrease in exports by 12.6% to 1.66 million bags. This is mainly due to the sharp decline in exports in April in Guatemala, Honduras, and Nicaragua, which decreased by 12.6%, 26.3%, and 22.9% respectively. The main reason is that Guatemala and Honduras are currently in the off-season of production and have received the impact of bad weather, resulting in a reduction in output.

Although the export volume in Asia and the Pacific region has decreased, the export volume of Robusta bags has increased by 13.4%. The situation of reduced production in Vietnam and Indonesia, coupled with the Red Sea crisis leading to pressure on the Eurasian shipping routes, has led to a sharp increase in global demand for Brazilian Robusta. In April 2023, Brazil only exported 120,000 bags of Robusta, while in April this year, it increased by 448.6% to 680,000 bags.

In this regard, the International Coffee Organization (ICO) expects that the global coffee production in the 2023/24 fiscal year will increase by 5.8% compared to the same period last year to 178 million bags, among which the output of Arabica coffee is expected to be 102.2 million bags, and the output of Robusta coffee is expected to be 75.8 million bags.

In the 2022/23 fiscal year, due to the impact of the COVID-19 pandemic, the increase in the cost of living and the decline in disposable funds, the demand for coffee in the 2022/23 fiscal year has decreased by 2% to 173.1 million bags. However, there are currently signs of a rebound, and the global demand for coffee consumption is starting to increase. It is expected that the global demand for coffee consumption in the 2023/24 fiscal year will increase by 2.2% to 177 million bags.

+ There are no comments

Add yours